Are your Broadband & TV bills fair?

Is your energy bill fair?

Is My Mobile Phone Bill Fair?

How Do I Switch My Mobile Provider?

Mobile Phone Guides

Is My Breakdown Bill Fair?

Car Breakdown Deals

Tell me about ismybillfair

The Loyalty Penalty

Are your insurance bills fair?

Increase your chance of finding a great deal by searching the market.

Purchase your car policy quickly and easily, monthly and annual payment options.

Fill in one simple form, compare prices, and start saving.

Join our ever-growing list of satisfied customers today.

The quote form uses 128-bit SSL encryption for your peace of mind.

We aren’t owned by or have any investment from any insurance company.

We've partnered with Quotezone.co.uk's van insurance comparison service. You’ll be able to compare quotes from up to 50 of the best van insurance providers in the UK in a matter of minutes, making it more likely that you’ll find a suitable insurance policy for your van at a price that won’t break the bank.

Compare quotes

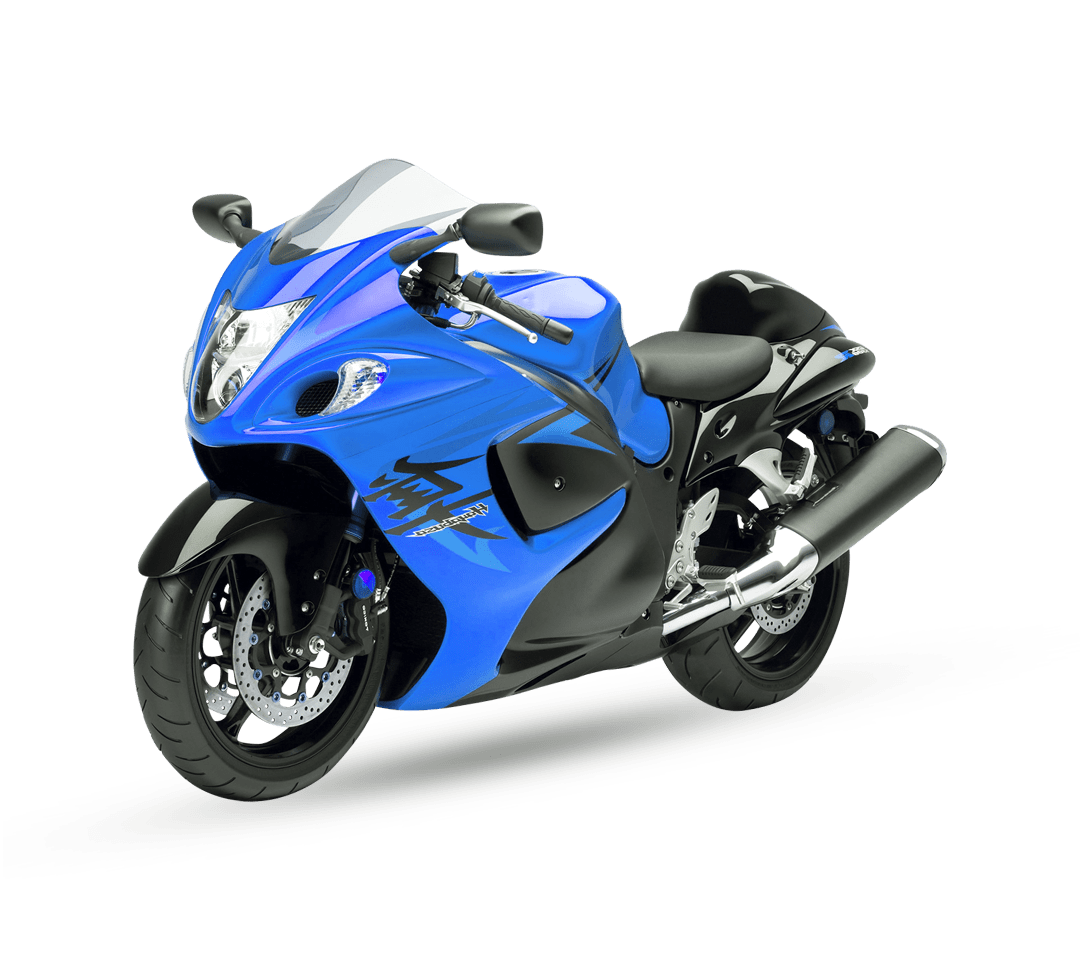

We've partnered with Quotezone.co.uk's motorbike insurance comparison service. You’ll be able to compare quotes from up to 25 of the best motorbike insurance providers in the UK in a matter of minutes, making it more likely that you’ll find a suitable insurance policy for your motorbike at a price that won’t break the bank.

Compare quotes

The new fully independent and unbiased travel insurance service allows you to compare policies from over 35 different providers, in just a few minutes. Get your quotes by filling in one simple form, compare prices, and start saving.

Compare quotes

We've partnered with Quotezone to help you compare 50+ home insurers in just minutes - including the likes of Axa, Hastings Direct and M&S Bank. Whether you need insurance for the building itself, or your prized possessions, or both, we've got you covered.

Compare quotes

We've partnered with Quotezone.co.uk's breakdown cover comparison service. You’ll be able to compare quotes from up to 10 of the best breakdown cover providers in the UK in a matter of minutes, making it more likely that you’ll find a suitable insurance policy at a price that won’t break the bank.

Compare quotes

We've partnered with Quotezone.co.uk's pet insurance comparison service. You’ll be able to compare quotes from up to 10 of the best pet insurance providers in the UK in a matter of minutes, making it more likely that you’ll find a suitable insurance policy at a price that won’t break the bank.

Compare quotes

We've partnered with Quotezone.co.uk's bicycle insurance comparison service. You’ll be able to compare quotes from up to 10 of the best bicycle insurance providers in the UK in a matter of minutes, making it more likely that you’ll find a suitable insurance policy at a price that won’t break the bank.

Compare quotes

*51% of consumers could save £504.25 on their Car Insurance. The saving was calculated by comparing the cheapest price found with the average of the next five cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from September 2023 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance supplier.